Assess the potential risks and rewards associated with digitization for equipment dealers to make informed decisions and navigate this transformative journey for your business.

There are many risks that threaten the financial health of equipment businesses. From grappling with unreliable data, to customer retention woes, and the relentless march of OEM businesses into the dealer market share territory, digitization has evolved to become more than just a strategy to streamline cumbersome processes – it is often required for survival.

“The reward with digitization is that it is an enabler to growth,” said Managing Director of Learning Without Scars, Ron Slee. “The risk with any technical adoption or transformation, is change management and the resistance to new ways of doing things. Change management is a challenge in any industry.”

For a successful transition from analog to digital systems, Slee recommends a multi-phase approach with an experienced and dedicated technology partnership.

“Finding the right platforms or partners who can start in one area and then enable easy growth allows for a lot of experimentation, and process changes,” he said. “This allows the change management process to work very effectively. There are great examples of customers that we work with who, over years and multiple phases, have really nailed the digitization process and extended it to multiple parts of their business. They have successfully managed to change with their teams and with their own clients as well.”

Even more compelling than the risks associated with digitization are the risks of failing to embrace this change.

The Crisis of Customer Churn

Slee points to customer retention as a critical area of concern for equipment dealers. Digitization, through the deliberate use of accurate data and a better understanding of the customer experience by the numbers, can help to reduce customer churn.

“One of the things that’s been troubling me for some time is customer retention,” said Slee. “Dealerships are operating in equipment, parts, service, rentals, finance, and many other individual departments. We’re in a situation where these transactions are completely different, so the quality of the data becomes critical. In many cases, we don’t have very good quality of data. As a result, I’ve seen dealers where they’re churning 25 to 75 percent of their customers annually without knowing it.”

Texada Software CEO, Matt Harris agrees that when it comes to customer churn, a little can go a long way in reducing equipment business profitability.

“Ron had the vision of introducing this customer retention data that we heard in terms of customer churn,” said Harris. “Essentially, the average dealership is churning about 5 percent of their customers every month, which on the one hand doesn’t sound that bad. Over a year, that’s 60 percent of the customers. That means that with any given dealership, 60 percent of their customers won’t do business with them next year.”

While the negative effects of customer loss likely vary by company, studies show that even small, incremental improvements can also yield big wins for businesses.

“It opens up a huge subject and not just for us, it’s all sectors of society,” said Slee. “What Harvard Business Review indicated when they looked at the industrial distribution businesses and found that if you can increase customer retention by five percentage points from 60 to 65, 70 to 75, for example, you can increase the profitability in the industrial distribution channel, which is equipment businesses, by 45 percent.”

Competitors Emerge

Digitization has also created a new level of competition for dealers which has challenged equipment businesses in surprising ways.

“The barrier to entry is very different today,” said Slee. “So, you’re going to see people sprouting up as fresh competitors, like Uber for technicians, for repair and maintenance, multi-source cross-references or parts, telematics with sensors and equipment that’s brand independent. There’s so many tools today that if you don’t put your arms around it, I’m afraid you will become extinct.”

Digitization has created a hyper awareness in the market. Organizations that possess this awareness can often gain the upper hand, even over dealerships that have made the original sale.

“There was one dealer who I thought made a very interesting observation or had a very realistic fear of the landscape becoming more complex with digitization,” said Harris. “As soon as that dealer sold a piece of equipment, they were instantly in competition with all these different, newly enabled competitors who were trying to sell parts to that customer. Previously, that customer would have been a reliable source of ongoing parts and service for that dealer, which is, we know, an important part of any dealer business. Now, the access to the parts comes from a variety of different sources, with all of them enabled through digital means, and those marketplaces are developing all the time.”

In a recent study by analyst firm McKinsey, equipment dealers indicated new competitive threats and direct-to-consumer sales models by OEMs as their top concerns.

“Dealers are not just competing against dealers within their region,” said Harris. “There is also all this extra competition that is arriving in an omni channel way from different approaches. So, it’s essential to digitize whether we want to or not.”

Building Customer Profiles

Some dealers are starting smaller with general rents, building loyalty and purchase patterns toward larger rentals, then graduating to heavy equipment.

“A very successful dealer on the East Coast talked about a smart strategy where they were really pushing into the general rents business, not only on the basis of growth of general rents, but as a way to introduce their business to new customers,” said Harris, “The thought behind it was that many customers won’t start a relationship just by buying a new piece of equipment. Beginning with equipment rental, be it small or large, was a great place to start.”

Using the data provided by digitization, businesses can better understand customer buying patterns.

“It’s digitization that makes it happen,” said Harris. “It’s understanding more about the customer and what their needs may be in the future for either further rental opportunities or equipment opportunities leading to parts and service.”

Harris notes that digitizing allowed this particular organization to create customer profiles using data available through purchase history to predict future behaviors and grow their business.

“That is what they did, they realized the promise of digitization.”

Equipment businesses are increasingly using digitization strategies to survive and thrive in a changing market. Whether it’s competition from OEM players, adapting to changes in buying patterns, or engaging the next generation of customers, digitizing can provide a way for dealers to tune their business toward success.

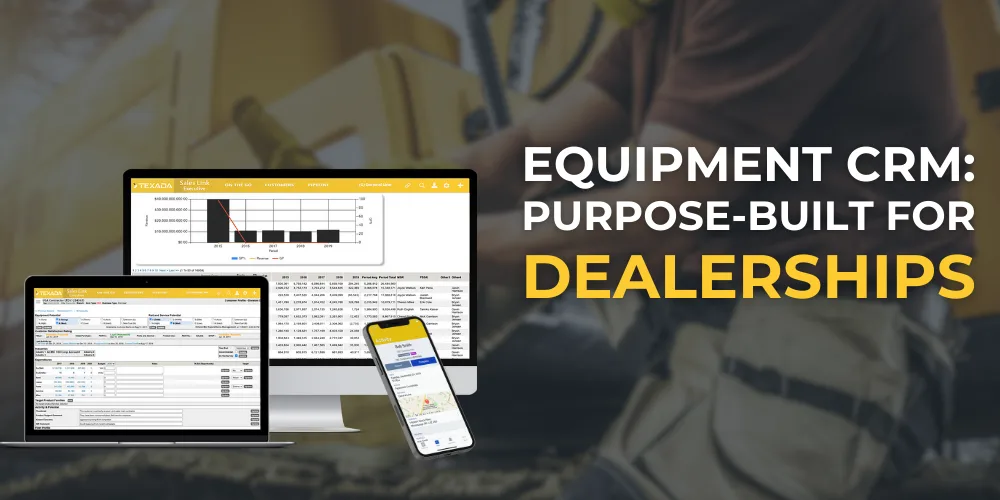

Take the Next Step Toward Digitization

Equipment businesses are beginning to realize the value of digitization.

Through customer conversations and industry insight, Ron Slee, Managing Director of Learning Without Scars, and Matt Harris, Texada Software CEO, provide a deeper understanding into digitization, automation, and other trends influencing the market in Texada’s Dealer Digest. Additionally, they offer key strategies for equipment dealerships to better leverage digitization to gain a business advantage. Access the Dealer Digest report: