Integrated payment solutions are the cornerstone of efficient, seamless, and error-free payment processing for businesses of all sizes. At its core, payment processing facilitates transactions between customers and merchants, often traversing a labyrinthine network of banks, card networks, and payment gates. Integrated solutions harmonize this complexity by directly embedding payment processing capabilities within the operational software environment, streamlining the payment process.

When integration is part of the equation, it transcends mere transaction handling to become a powerful engine that drives the business forward. It impacts the payment process by enabling fast, secure, and convenient transactions for merchants and consumers, all within the merchant’s primary software interface.

Moreover, the strategic role of software in this orchestrated symphony can’t be overstated. It serves as the maestro, simplifying the collection of payments and enhancing data management, providing deep insights through analytics, and ensuring the smooth passage of financial data across a unified system. Dive into integrated payment solutions to unlock the full potential of your business’s financial operations.

Getting paid doesn’t have to be complicated. With payments being an integral part of your rental business, the process must be as easy and instant as possible. In this article, we explain why integrating your payments with your rental software can translate to simplified operations, happier customers, and a happier team. Let’s dig in!

Optimizing Payment Processing Efficiency

The cornerstone of any modern business is the ability to process payments swiftly and reliably. By streamlining these processes, companies can achieve efficiency that benefits their operations and enhances customer satisfaction. Integrated payment solutions play a pivotal role in this optimization.

Reducing Steps in the Payment Process

Efficiency in payment processing is paramount. Integrated payment solutions help by reducing the steps required to complete a transaction. This simplification speeds up the process, minimizes the likelihood of errors, and ensures that customers face fewer barriers when making the payment, leading to a smoother checkout experience.

Time-Saving Benefits for Businesses and Customers

Cutting unnecessary steps isn’t just about speed—it’s about time savings for businesses and customers. Integrated payment solutions automate various tasks, from data entry to transaction processing, which frees up valuable time for both parties. As a result, businesses can allocate more resources to growth and customer service while customers enjoy a quick and hassle-free payment experience.

Pro Tip: Leverage integrated payment solutions to reduce transaction steps and automate tasks. This will save your business and customers valuable time and ultimately enhance efficiency and customer satisfaction.

Cost Reduction and Fee Transparency

In financial transactions, integrated payment solutions stand out for enhancing workflow efficiency and their potential to significantly reduce processing costs. When payments are integrated into a business’s primary systems, it streamlines operations and can trim down expenses associated with manual reconciliation and data entry errors.

The Impact of Integrated Solutions on Overall Payment Processing Costs

With the adoption of an integrated payment solution, businesses can experience a noticeable decline in costs. By consolidating payment processing with other business systems, companies often benefit from lower transaction fees due to higher processing volumes and improved bargaining power with payment service providers.

Spotlights on Fee Structures and How to Anticipate Charges

Understanding fee structures is crucial when considering an integrated payment solution. Transparent pricing models aid businesses in better forecasting their expenses. Some common fees to be aware of include transaction fees, monthly account fees, gateway fees, and chargeback fees. It is important to recognize these costs upfront to make informed decisions.

Tips on Selecting Transparent Providers to Avoid Hidden Fees

- Look for providers who offer clear, straightforward pricing without hidden charges.

- Ask for a full disclosure of all potential fees, including circumstances that could trigger additional charges.

- Read reviews and contact the provider’s current clients to ensure their experience aligns with its claims.

- Ensure the provider’s contract terms are unambiguous and confirm that you can obtain full pricing information before signing.

Streamlined Checkout Experience

The pace of today’s e-commerce environment demands a checkout process that is as quick as it is intuitive. A simplified checkout translates directly into higher conversion rates, with integrated payment solutions playing a pivotal role. By minimizing the steps and time required to complete a purchase, businesses remove barriers that might otherwise result in cart abandonment.

Enhancing Customer Checkout with Integrated Solutions

Integrated payment solutions revolutionize the checkout experience by consolidating payment processing and other essential services into one seamless workflow. This integration offers a more efficient transaction process for both customers and businesses. Customers enjoy a smoother, less cumbersome checkout, while businesses benefit from the reduced chance of errors and accelerated transaction times.

Examples of Streamlined Checkout Flows

- One-Page Checkout: By consolidating the entire checkout process onto a single page, customers can fill in their information rapidly without navigating multiple pages.

- Autofill Capabilities: Integrated payment systems that store customer information can pre-populate fields, further expediting the checkout process for returning customers.

- Real-Time Payment Processing: Instantaneous verification and processing of payments means that customers don’t have to wait for their transactions to clear, leading to a smoother checkout experience.

In conclusion, the agility provided by integrated payment solutions is indispensable in crafting a checkout experience that meets the expectations of modern consumers and keeps businesses competitive in a fast-moving digital marketplace.

Multi-Channel Payment Acceptance

In today’s fast-paced market, an integrated payment solution must offer more than just a single payment gateway. The true value lies in Multi-Channel Payment Acceptance, allowing customers to make purchases whenever and however they choose. This level of convenience is not just a luxury; it’s a requirement for businesses aiming to succeed in the digital economy.

The key advantage of multi-channel payment options is the convenience of accepting payments across various platforms. Whether your customers are shopping from their desktop, browsing on a tablet, or making a quick purchase via their smartphone, they expect seamless transaction capabilities. By integrating online, in-store, and mobile payments into one cohesive system, businesses can offer a unified experience that caters to the modern consumer’s demand for fluidity and ease of use.

- Integrating online, in-store and mobile payments streamlines the operation from a managerial standpoint and provides a consistent and reliable customer experience across all sales channels.

- Moreover, adapting to changing customer payment preferences is crucial to staying relevant and competitive. Allowing for various payment methods, including digital wallets and contactless payments, ensures that your business meets the expectations of all customer segments.

In conclusion, an integrated payment solution with robust multi-channel payment acceptance is essential for businesses looking to offer convenience, adapt to customer preferences, and maintain a competitive edge in the marketplace.

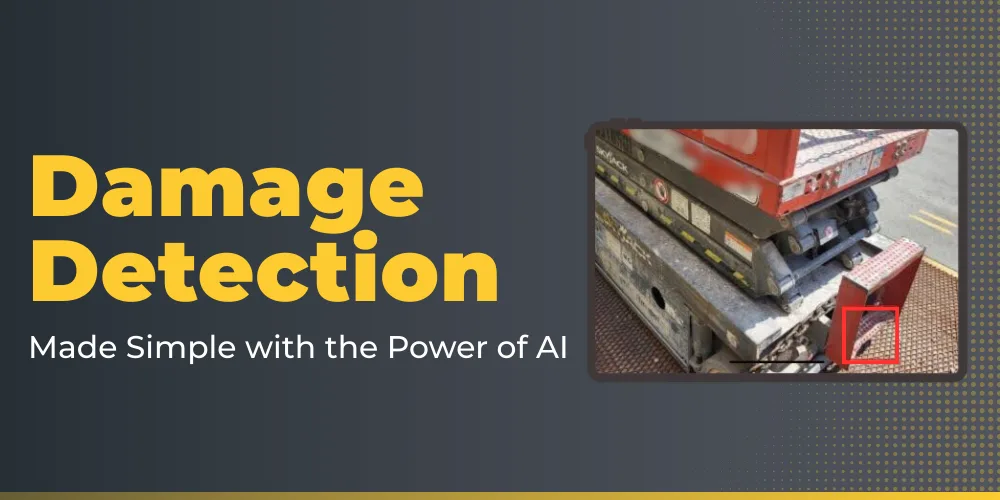

Enhanced Security and Fraud Prevention

Payment processing security is paramount for small and medium-sized businesses (SMBs). With cyber threats evolving rapidly, these businesses face significant security challenges that can compromise sensitive customer data and tarnish their reputation.

| Aspect | Description |

| Enhanced Security and Fraud Prevention | |

| Importance for SMBs | Payment processing security is crucial for SMBs to protect sensitive customer data and maintain their reputation. |

| Protection Features | Integrated payment solutions offer advanced security measures, including: |

| – End-to-End Encryption: Scrambles data during transmission. | |

| – Tokenization: Replaces sensitive data with unique identification symbols. | |

| – Fraud Detection Algorithms: Analyze transactions for suspicious activity. | |

| PCI DSS Compliance | Ensures secure handling of credit card information to avoid non-compliance penalties. |

| Integrated solutions have built-in features to facilitate compliance. | |

| Improved Cash Flow Management | |

| Real-Time Cash Flow Monitoring | Allows businesses to track cash flow with greater accuracy and speed, aiding in informed decision-making. |

| Strategies for Healthy Cash Flow | Timely payment processing reduces sales and fund availability lag, enabling better budgeting and planning. |

| Data-Driven Financial Decisions | Transaction data provides actionable insights for cost-saving and investment opportunities. |

| – Quicker identification of financial trends and abnormalities. | |

| – Better forecasting based on up-to-date financial data. | |

| – Enhanced ability to strategize and adjust for future cash flow requirements. |

Seamless Integration with Your Current Systems

Implementing an Integrated Payment Solution into your existing business infrastructure should not be complex. With careful planning and support, the integration process can be smooth and hassle-free, ensuring your operations continue uninterrupted.

Ensuring Compatibility for a Unified Approach

Verifying the compatibility of the Integrated Payment Solution with your current business software is crucial for maintaining efficiency across your operations. This compatibility ensures that all components of your business ecosystem can communicate and work together seamlessly, enhancing overall operational effectiveness.

Simple Steps to Seamless Integration

- Assessment of current systems to understand integration requirements.

- Planning the integration process with minimal disruption to ongoing processes.

- Executing the integration with step-by-step guidance from the solution provider.

- Testing the integrated system thoroughly to ensure full functionality.

Dedicated Support for SMBs

Small and medium-sized businesses (SMBs) can benefit from the dedicated support and resources available for integration. Providers of Integrated Payment Solutions often offer specialized assistance, toolkits, and customer service to ensure that SMBs experience a smooth transition and can effectively leverage integrated payments’ power in their day-to-day transactions.

Scalability for Business Growth

Scalability is a crucial component of modern business, and integrated payment solutions are pivotal in catering to this need. As your business expands, your payment processing system must be capable of handling increased transaction volumes without compromising on efficiency or security. Selecting a payment platform that scales in tandem with your business is not just an option but a necessity for sustainable growth.

The Role of Payment Solutions in Supporting Business Expansion

Integrating a payment solution that supports growth means ensuring your payment infrastructure can accommodate new sales channels, customer bases, and the global marketplace. The ability to quickly adapt to higher demands and complex transactions can make or break your business’s ability to capitalize on new opportunities.

Choosing a Flexible Platform That Grows with Your Business

A fundamental aspect of a scalable integrated payment solution is its flexibility. The ideal platform offers various payment options and can adjust to evolving business models, whether moving from a local storefront to an online marketplace or scaling from a small operation to a large enterprise.

Preparing Your Payment Infrastructure for Increased Transaction Volume

As transactions increase, the reliability of your payment infrastructure becomes critical. It is essential to ensure that your system can handle spikes in transaction volumes without downtime or delays, which could otherwise result in lost sales and negatively impact customer experiences.

- Efficient transaction processing: To keep up with the growth, the system should process payments quickly and reliably during peak times.

- Security scalability: As businesses grow, so does the attractiveness of fraudulent activities. Your solution must enhance security measures in parallel with your growth.

- Capacity planning: Anticipating future needs and planning capacity can prevent bottlenecks and maintain smooth operations.

Pro Tip: Choose a payment platform with flexible scalability features to ensure it can handle increased transaction volumes and evolving business models, thereby preventing bottlenecks and maintaining efficient and secure operations as your business grows.

Maximizing Customer Satisfaction and Retention with Integrated Payment Solutions

The success of your business hinges not only on attracting new customers but also on retaining them. Integrated payment solutions are crucial in fostering customer loyalty and repeat business through seamless payment experiences. Let’s explore the connection between sophisticated payment systems and customer satisfaction.

Enhancing Loyalty with Smooth Payment Experiences

Customer loyalty often directly reflects how effortless the payment process is. An integrated payment solution ensures quick, reliable, and secure transactions, translating to a positive checkout experience. This convenience makes customers more likely to return and is essential to long-term business success.

Tailoring Offerings Using Payment Data

Leveraging the valuable data gathered from integrated payment systems allows businesses to design personalized offers and rewards. A strategic approach to using this data can lead to targeted promotions encouraging customers to become repeat buyers, thereby increasing the overall customer lifetime value.

Pro Tip: Use integrated payment solutions to create seamless, secure, quick transactions, enhancing customer satisfaction and loyalty. Leverage payment data to tailor personalized offers and rewards, driving repeat business and increasing customer lifetime value.

Mobile Payment Capabilities in Integrated Payment Solutions

Smartphones have ushered in a transformative era for payment methods, with mobile payments becoming an integral facet of customer transactions. For small and medium-sized businesses (SMBs), integrating mobile payment options is no longer a luxury but a vital component for staying competitive in today’s dynamic marketplace. Embracing this payment method can significantly enhance customer convenience and satisfaction.

The Importance of Mobile Payments for SMBs

With increasing numbers of consumers relying on their mobile devices for purchases, SMBs must adapt to their customers’ preferred payment styles. Integrating mobile payment solutions allows businesses to cater to the modern consumer’s need for quick and effortless transactions, improving the overall customer experience.

Integrating Mobile Payment Solutions

Incorporating mobile payment systems into existing infrastructure is a crucial step for businesses. An integrated payment solution encompassing mobile payment capabilities ensures a smooth transition and interoperability with current processes. This seamless integration is key to maintaining operational efficiency while expanding payment options.

Enhancing On-the-Go Payment Processes

Customers demand the flexibility to make payments whenever and wherever they choose. By implementing a robust mobile payment system within an integrated solution, companies can offer an expedited payment process, allowing for transactions to occur in real-time, thus facilitating on-the-go purchases and elevating the user experience.

- The rising trend of mobile payments highlights the importance of versatile and secure payment methods.

- Seamless integration of mobile payment solutions ensures SMBs can offer state-of-the-art payment options.

- Enhancing on-the-go payment processes simplifies the purchasing experience, positively impacting customer satisfaction.

Pro Tip: Seamlessly integrate mobile payment solutions into your existing infrastructure to cater to the increasing consumer demand for quick, effortless, and on-the-go transactions, enhancing customer satisfaction and maintaining a competitive edge.

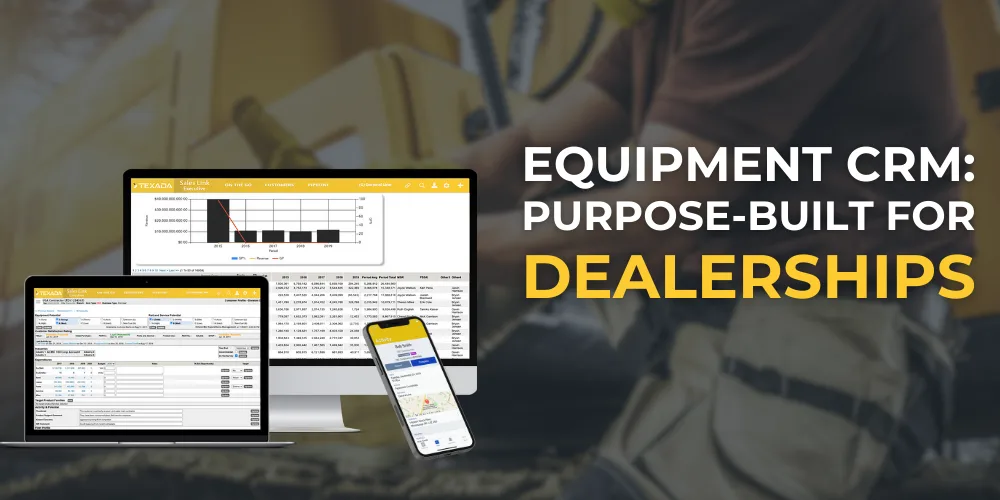

Empower Your Business with the Right Integrated Payment Solution

As we’ve explored throughout this guide, integrated payment solutions play a pivotal role in the ability of small and medium-sized businesses (SMBs) to succeed in a competitive digital marketplace. These systems are indispensable, from enhancing processing efficiency and offering cost reductions to streamlining the checkout experience and ensuring robust security.

Let us take a quick look at the crucial points discussed in this article about the benefits of using an integrated payment solution:

Increase Cash Flow

It can be challenging to get customers to pay invoices on time. When contracted receivables age over 90 days, recovering the payment is difficult. Waiting for cheques to arrive in the mail or e-transfers to be completed is tedious and time-consuming, ultimately squeezing your cash flow.

With integration, you unlock new and better methods to manage your payments. Some examples include:

– Offering a wider variety of payment options to customers.

– Collecting invoice payments directly through a self-service web portal.

– Sending invoices through email with a ‘pay here’ link.

– Applying payments to Accounts Receivable and General Ledger as they are collected without needing to reconcile manually.

Reduce Human Error

Whether you record details incorrectly, enter the wrong amount in your payment terminal, or apply the wrong data to accounts, mistakes are bound to happen.

Integrating your payment terminals and rental software displays transaction totals on the card reader without manual entry. It can eliminate errors and improve day-to-day reconciliation by removing any discrepancies between what was invoiced and what was collected.

For repeat business, you can securely store customer credit card and bank account information on file. It minimizes the time spent re-entering information for every transaction. You can get paid faster, capture payments during rental returns, or implement cycle billing. Additionally, you will automatically be notified if cards have been lost, stolen, or expired, reducing the possibility of declines.

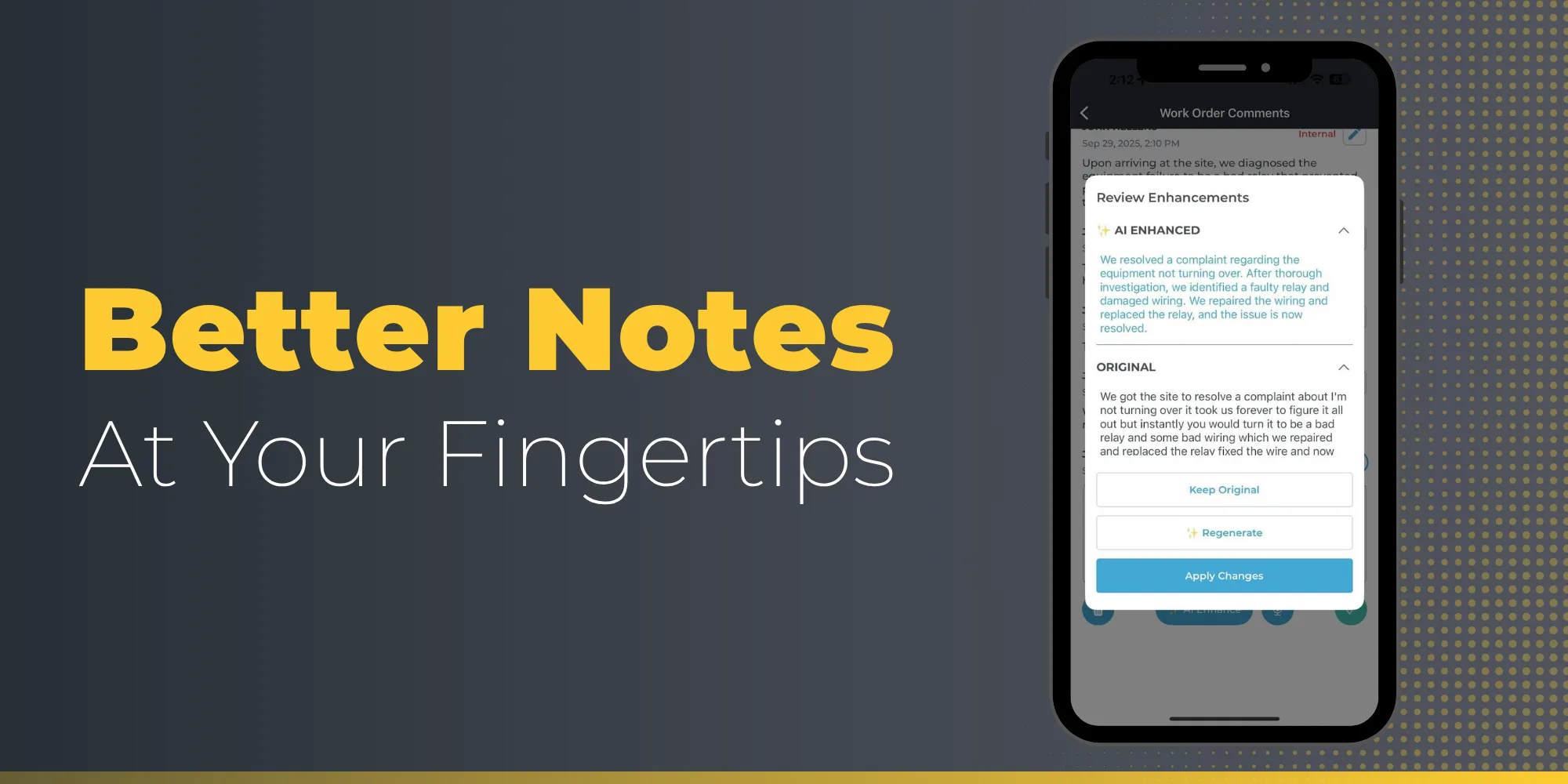

Optimize Your Workflow

Streamline transactions by eliminating manual steps that take a lot of time. With real-time information shared between your rental software and payment processor, workflows are optimized for every transaction in person, over the phone, and online.

“We are able to get customers in and out of the store much quicker. Now that we are taking deposits rather than pre-authorizations, we are able to ensure payment is received at the beginning of every contract,” says DJ Robertson, owner of Robertson Rental-All, when discussing his recent experiences with integrated payment processing.

In the back office, manually inputting payments in your accounting system takes significant effort. Integrating payments reduces the need for double entry, allowing you to shift resources from data entry chores to areas that accelerate business growth and profitability.

Improve Customer Experience

More than ever, your customers want to be in charge of their payments. Now, you can easily provide that convenience for them.

Whether through a self-service option, a digital “pay here’ link, or an opt-in to auto-pay, your customers will enjoy the flexibility and convenience. In addition, with less manual entry involved, you will have more time to focus on those most important to your company.

Strengthen Security

As a business owner, it can be extremely easy to overlook outdated workflows. We’ve all heard the adage, ” If it ain’t broke, don’t fix it.”However, with data breaches increasing, mishandling credit card information can have a severe, long-lasting impact on your business. The best option is to set yourself up for success while mitigating risk.

Using an integrated PCI DSS-compliant solution protects your business by tokenizing bank account and credit card details. It means you can collect payments without storing the actual credit card or bank account details in your system. Now, you can easily reassure your customers that all their data is protected.

With the array of benefits, we encourage you to assess your current payment processes and consider how an integrated payment solution can align with and fulfill your business objectives. It’s an investment into your company’s infrastructure that promises to yield substantial returns through efficiency, security, and customer engagement.

Take the Next Step Toward Payment Integration

Don’t let the opportunity to optimize your payment systems pass you by. We invite you to explore further and consult experts to find the most suitable payment integration options for your business. Whether you’re interested in the details of security measures, compliance requirements, or specific features like mobile payment capabilities and recurring billing, take action today to secure a seamless payment experience for your customers tomorrow.

Here at Texada, we are thrilled to provide our customers with a powerful payment integration platform called Texada Pay. If you want to learn more, one of our software experts would love to speak with you about how Texada Pay can help optimize your payment processes.

[Speak to an Expert button]

Key Takeaways

- Integrated payment solutions streamline the payment process by automating tasks and reducing manual entry. It leads to fewer errors and faster transactions, improving operational efficiency and customer satisfaction.

- With transparent pricing models offered by integrated payment solutions, businesses can reduce processing costs and avoid hidden fees. Selecting providers with clear, straightforward fee structures is crucial for managing expenses effectively.

- Integrated payment systems provide robust security measures, including end-to-end encryption and tokenization, ensuring compliance with PCI DSS standards and protecting sensitive customer data from breaches.

- These solutions are scalable, supporting business growth and handling increased transaction volumes. They also enhance customer experience through streamlined checkout processes, mobile payment capabilities, and personalized payment options, fostering customer loyalty and retention.